Mastering the art of trading is essential for investors seeking to make informed decisions and maximize their returns. Two fundamental tools at your disposal are Market Orders and Limit Orders. In this comprehensive guide, we will delve into the nuances of both order types, providing you with the knowledge and expertise to navigate the financial world confidently.

Market Order: Seizing Opportunity

A Market Order is like a swift arrow aimed at hitting a moving target. When you place a Market Order, you instruct your broker to buy or sell a security immediately at the current market price. This type of order is characterized by its speed and execution certainty. It’s ideal for investors who want to seize an opportunity without delay, regardless of the price at the moment.

Limit Order: Precision in Trading

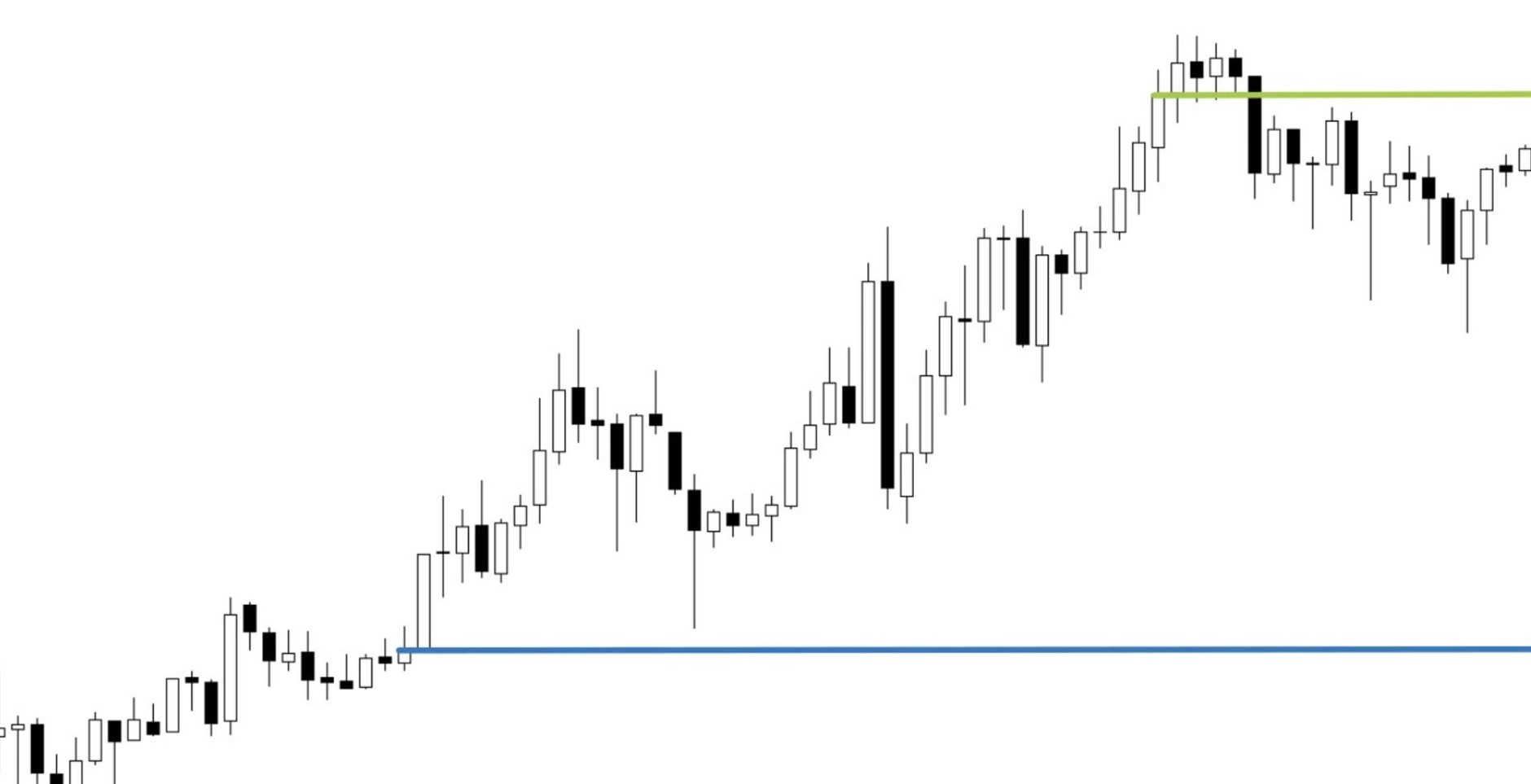

In contrast, a Limit Order is more akin to a patient hunter, waiting for the right moment to strike. When you set a Limit Order, you specify a price at which you are willing to buy or sell a security. The trade will only occur if the market reaches your designated price point. Limit Orders provide control over the entry and exit points of a trade, making them a preferred choice for investors who want to be more strategic and price-conscious.

When to Use a Market Order

Capitalizing on Momentum

Market Order: The phrase itself suggests swift action. Market Orders are your go-to choice when you want to capitalize on the momentum of a security. This is especially useful in fast-moving markets or when news events are driving prices. If you believe that hesitation might cause you to miss out on an opportunity, a Market Order is your ally.

Liquidity Matters

Market Order: Liquidity plays a crucial role in trading. If you’re dealing with highly liquid assets, such as blue-chip stocks or major currency pairs, Market Orders are efficient because they can be executed instantly without significant price slippage. In these cases, you can rely on the market to absorb your order without causing substantial price changes.

No Fixed Price Target

Market Order: Sometimes, your trading strategy might not depend on a specific price target. You might be more concerned with securing a position quickly. Market Orders are perfect for such scenarios, as they prioritize execution speed over price precision.

Day Trading and Scalping

Market Order: Day traders and scalpers, who aim to profit from small price movements within a single trading day, often favor Market Orders. The urgency and quick execution align with their strategies, allowing them to enter and exit positions swiftly.

When to Use a Limit Order

Price Precision

Limit Order: If you have a specific price in mind for buying or selling a security, a Limit Order is your tool of choice. It ensures that your trade will only be executed when the market reaches your predefined price level. This precision can help you avoid unexpected losses or overpaying for assets.

Volatile Markets

Limit Order: In highly volatile markets, where prices can fluctuate rapidly, Limit Orders provide a safety net. They shield you from sudden price spikes or crashes by ensuring that your trade is only executed at your chosen price. This is particularly valuable for risk-averse traders.

Long-Term Investing

Limit Order: Investors with a long-term perspective often use Limit Orders for strategic buying or selling. By patiently waiting for the market to reach their desired price, they can secure favorable entry or exit points for their investments, ultimately optimizing their returns.

Avoiding Emotional Trading

Limit Order: Emotions can cloud judgment in trading. Limit Orders help traders stick to their predefined strategies without getting swayed by market sentiment. This disciplined approach can lead to more consistent and rational decision-making.

Market Order vs. Limit Order: Real-World Scenarios

To truly grasp the power and significance of Market Orders and Limit Orders, let’s explore some real-world scenarios.

Scenario 1: Earnings Season

Market Order: During earnings season, when companies release their financial reports, market volatility tends to spike. Traders expecting significant price movements may use Market Orders to swiftly enter or exit positions based on earnings results.

Limit Order: Conversely, risk-averse investors may place Limit Orders at specific price levels to avoid the unpredictable post-earnings market swings. This allows them to control their entry and exit points with precision.

Scenario 2: IPO Hype

Market Order: Initial Public Offerings (IPOs) generate considerable buzz in the stock market. Investors eager to secure shares of a hot new company may opt for Market Orders to ensure they don’t miss out on the IPO’s early trading frenzy.

Limit Order: Prudent investors, however, might set Limit Orders at a more reasonable price, waiting for the initial hype to subside. This cautious approach can prevent them from overpaying during the IPO frenzy.

Scenario 3: Long-Term Investment

Market Order: Suppose you’re a long-term investor eyeing a particular stock, but you believe it’s overvalued at the moment. You might choose to place a Market Order when the stock experiences a sudden drop, allowing you to enter at a more favorable price.

Limit Order: On the other hand, if you have a specific target price in mind, you can set a Limit Order and patiently wait for the stock to reach that level. This disciplined approach ensures you invest at your desired price point.

FAQs

Can I change a Market Order to a Limit Order after it’s placed?

Yes, in most cases, you can modify or cancel a Market Order before it gets executed. However, once it’s executed, you cannot change it to a Limit Order.

Are Limit Orders always executed at the specified price?

Not necessarily. While Limit Orders are designed to be executed at the specified price or better, there is no guarantee that they will be filled if the market doesn’t reach your designated price.

Which order type is riskier for day trading: Market Order or Limit Order?

Market Orders are generally riskier for day trading because they prioritize speed over price. This can lead to higher price slippage in volatile markets.

Can I use Market Orders and Limit Orders together in the same trade?

Yes, traders often use a combination of Market and Limit Orders in complex trading strategies. For example, you might use a Market Order to enter a position quickly and then set a Limit Order to take profits or limit losses.

Are there any fees associated with Market Orders or Limit Orders?

When it comes to trading, understanding the cost implications of your actions is crucial. Market Orders and Limit Orders may both serve specific purposes in your trading strategy, but they can come with different fee structures. Let’s take a closer look at the fees associated with these two order types:

|

Aspect |

Market Order |

Limit Order |

|

Execution Speed |

Rapid execution, often at the current market price. |

Execution occurs only when the market reaches your set price. |

|

Price Control |

Little to no control over the execution price. |

Control over the execution price, but no guarantee of execution. |

|

Price Impact |

May experience price slippage in volatile markets. |

Protection from price fluctuations until your set price is met. |

|

Associated Fees |

Brokerage fees may vary but can be lower due to market prices. |

Brokerage fees may be higher due to the need for precision. |

|

Strategy Suitability |

Ideal for seizing immediate opportunities. |

Ideal for strategic entry and exit points. |

It’s essential to note that brokerage firms have their fee structures, which can differ significantly. Market Orders are often associated with lower fees since they prioritize execution speed over price precision. In contrast, Limit Orders may incur slightly higher fees because they require the broker to wait for a specific price to be reached. When deciding between Market Orders and Limit Orders, consider not only your trading strategy but also the associated costs, which can impact your overall returns.

How do I decide which order type to use in a given situation?

Your choice between a Market Order and a Limit Order should align with your trading strategy, goals, and risk tolerance. Consider factors like market conditions, asset liquidity, and your desired level of price precision.